As published in The Next Platform

Seven years ago, it was the end for SGI. The legendary company had gone bankrupt, its remains were up for liquidation, and its relatively few remaining

loyal customers were left in limbo.

This week, SGI reached a new ending, significantly different from its last one, as HPE announced an intended deal to purchase the company for approximately

$275 million.

SGI was reincarnated in 2009 when Rackable bought its assets, including its brand, off the scrap heap, for only $42.5 million (originally reported

as $25 million at the time, but later updated). Rackable—that is to say, the new SGI—protected employees, key products, and customer

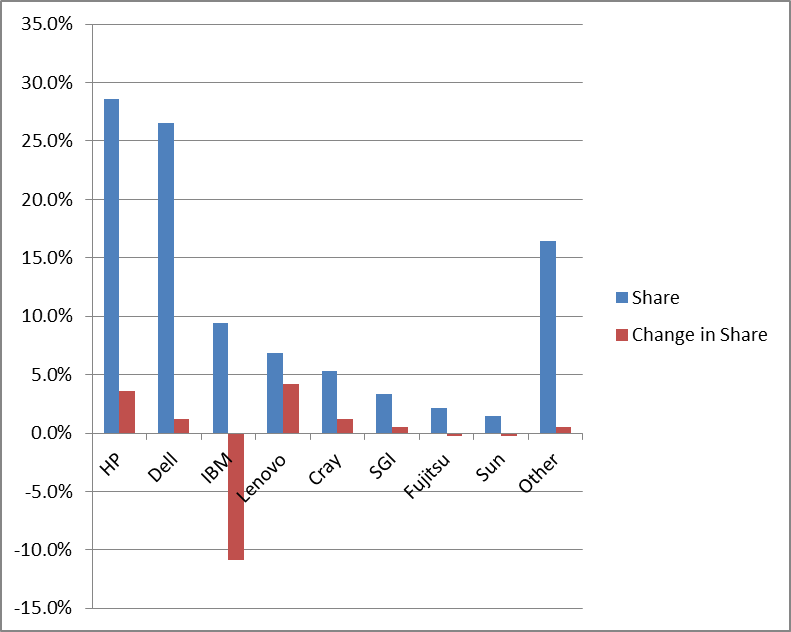

commitments, and the company persevered, even if it didn’t quite thrive. From a nadir of a 2.0% HPC server market share in 2008-09, SGI came back

to 3.3% in 2015 (down from a high of 4.2% in 2012), while the market rebounded with 50% aggregate growth since those recessionary years.

Over that span, SGI has done many notable things in HPC, expanding its cluster offerings to complement its signature large shared-memory systems. And

it continued to win isolated key customers in every major geographical region, including Petaflop-scale supercomputers in government (NASA Ames

and NCAR, U.S.), academia (U. Tokyo, Japan), and industry (Total, France).

Worldwide HPC Server Market Share, by Vendor, 2014 vs. 2015 – Intersect360 Research, 2016

SGI’s success, where it has found it, has always been entrenched in technology, but beyond product differentiation, what has been truly remarkable

about SGI’s run is the cultish loyalty of its customer base. In a satisfaction survey from 2009, the year SGI went bankrupt, we found that end

users ranked SGI higher than IBM, HP, Dell, and Cray in “overall performance of platform,” the top-ranked criterion for system evaluation. In a

2013 qualitative study, one manufacturer called SGI “the best value, the strongest partner,” while another offered, “It’s been interesting to watch

SGI since the early ‘90s. The only thing we ever really got good performance on were the shared memory machines.”

This loyalty was built from a long heritage in working with HPC problems, putting in years of work to find optimized solutions. Another key end-user

comment on vendor evaluation: “We’ll place a premium on those with support groups specific to CAE space, like SGI.”

But expanding the cult was always SGI’s problem. Like a fringe political party, the company had ardent supporters, but outsiders were hesitant to adopt

the minority platform, even if they agreed with many of its fundamental tenets.

The seven years since we last reported SGI’s final chapter has offered more of the same fits and starts, as SGI still struggled to find a reliable

path to consistent growth and profits.

- SGI invested in a differentiated storage strategy, but backed away when it couldn’t command a premium for its products.

- For two years the company’s primary marketing push was to extend the benefits of shared-memory architectures to big data applications, particularly

SAP HANA. SGI’s brand and sales channels didn’t arc well to enterprise, and any moderate gains were offset by losses in the core HPC space. - A price book agreement with Dell never showed real promise. Dell has had little incentive to push the SGI gear, and any customer who wanted it

could find it from SGI just as easily.

And so SGI found itself in a familiar position: in possession of compelling technology and a core set of zealous customers from entry-level to petascale,

and no significant awareness registered in the greater world beyond. It has been a perpetual cycle of well-applauded launches, all failing to reach

escape velocity; the president of the astronomy club has never gotten any consideration for prom queen.

If HPC server market shares really were a teen movie, this is the point at which the handsome star quarterback would notice the brainy girl behind

the glasses. She’d get a makeover, have a smashing debut at the homecoming dance, and the cafeteria crowd would marvel that she’d been beautiful

all along. And in an appropriately modern resolution, her intellectual assets would save the football team, the school, and maybe the world. Go

Astronomy Club!

Enter HPE, star quarterback. The number-one HPC server vendor has a cross-demographic appeal that makes the company popular in the enterprise in-crowds

too. Right away, HPE can bring SGI technologies to parties that the intellectually adept but socially awkward company never got invited to. It’s

not that shared memory for big data was ever a bad idea. For some workloads it could be brilliant. What will happen when all of a sudden SGI is

on the A-list, as HPE’s plus-one?

But the long-term possibilities of the new power couple go beyond this year’s society calendar. There is a lot of potential in integrating some of

the technologies. Imagine, for example, the incorporation of SGI’s NUMAlink into HPE’s Apollo servers, or Integrity, or The Machine.

If HPE starts by doing what Rackable did seven years ago, protecting SGI’s core technologies, customers, and domain-specific expertise—and really,

if you weren’t going to do just that, then why on earth would you buy SGI?—this movie will have a compelling plot that will be fun to watch.

And if SGI’s true talents finally find a bigger market? That will be the fairy-tale ending they’ve been looking for all along.

Addison Snell is the CEO of Intersect360 Research and a veteran of the High Performance Computing industry. Addison was previously an HPC industry

analyst for IDC, where he was well-known among industry stakeholders. Prior to IDC, he gained recognition as a marketing leader and spokesperson

for SGI’s supercomputing products and strategy. Addison holds a master’s degree from the Kellogg School of Management at Northwestern University

and a bachelor’s degree from the University of Pennsylvania.